In age electronic digital banking, we frequently neglect the importance of the traditional teller windows. The teller window is a vital a part of banking that permits customers to complete transactions quickly and efficiently. The teller home window ensures that clients get substantial-high quality customer support, in addition to their economic teller windows requirements are fulfilled promptly. In the following paragraphs, we are going to investigate some great benefits of the teller windows and its performance in business banking professional services.

Individualized Customer Care:

One of several substantial features of the teller windowpane is it offers personalized customer support. Consumers can interact with a teller deal with-to-experience and get inquiries and make clear their doubts as an alternative to depending on chatbot support. Teller windows aid buyers really feel protected knowing that somebody is handling their financial transactions, as opposed to feeling like they can be carrying out the dealings by yourself. The teller window can endear clients for the business banking sector and feel like they may be component of a community.

Rate and Productivity:

The teller windows is likewise very fast and productive. Teller microsoft windows really are a existence-saver during dash 60 minutes and holidays when Atm machine lines are very long. Most banks have several teller home windows open through the day, enabling a lot fewer hang on occasions and quick transactions. A skilled teller can finish a fiscal deal with fantastic pace, making sure that clients are not waiting in lengthy lines. The teller windows is the best thing for buyers that need a fast financial deal.

Versatility:

Due to the mobility of the teller home window, it might give significantly more than simply down payment and drawback characteristics. Some tellers are professionals in certain services like foreign currency change, personal loan questions, and more. This benefit-added support makes certain that consumers have their business banking requires met on the a lot more private and tailored stage.

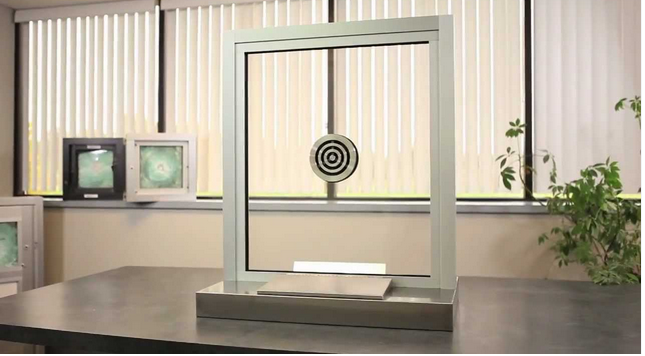

Authorization and Safety:

Safety is crucial in consumer banking, and teller house windows present an additional degree of safety that customers can depend upon. Banks normally have substantial-quality security measures set up and knowledgeable tellers who are able to rapidly establish deceptive actions. Teller house windows in addition provide risk-free processes for clients when they wish to withdraw or put in big sums of money.

Encourages Protecting Habits:

The teller windowpane facilitates the price savings habit in consumers by marketing little cost savings banks. Some banks have saving makes up about youngsters that encourage conserving behavior, and financial institutions utilize the teller windows to teach consumers on savings and financial. The teller home window not only provides economic guidance but will also help consumers determine financial literacy that might be valuable over time.

In short:

The teller windowpane stays one of the most crucial areas of banking. It enables customized customer service, pace, effectiveness, mobility, authentication, stability, and financial savings behavior to buyers. While on the web financial is rapidly increasing, the teller window continues to be essential for those who seek out the most effective financial transactions and customized customer care. The teller windows is not only a method of carrying out banking institution purchases, nevertheless it works as a appreciated customer experience that may be essential in today’s financial scenario.